4 Wall Ebitda

A four wall analysis provides a simple yet effective way of managing the moving financial parts.

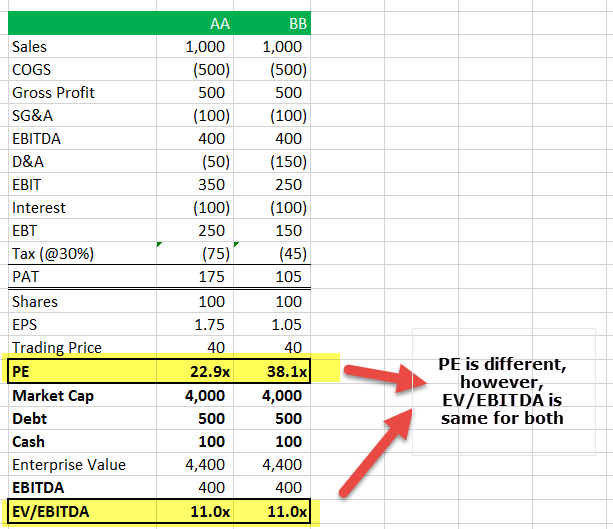

4 wall ebitda. The 4 wall ebitda is the ebitda for the retail store itself. It doesn t include things like corporate overhead head office labor and so on. 4 wall ebitda is the ebitda related only to the retail store itself meaning it includes cogs labor rent and 4 wall expenses but does not include corporate overhead charges head office labor etc. A large grocery store chain is interested in pre corporate or 4 wall ebitda because they are only going to buy the stores re brand them and plug them into their own distribution purchasing network.

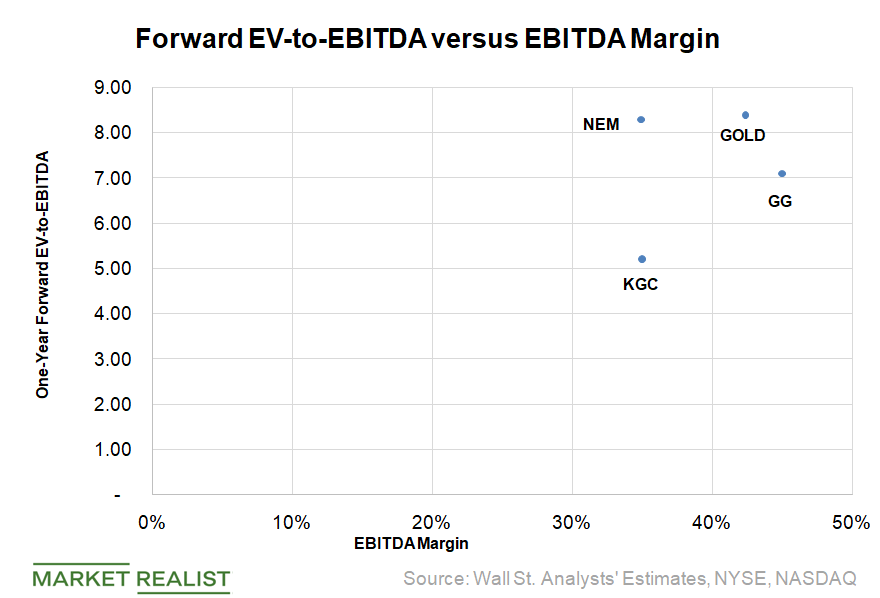

Ebitda margin is the operating profitability ratio which is helpful to all stakeholders of the company to get clear picture of operating profitability and its cash flow position and is calculated by dividing the earnings before interest taxes depreciation and amortization ebitda of the company by its net revenue. Also called four wall cash flow or four wall margins it reflects the sales of each store relative to the direct costs required to operate the store such as rent utilities wages inventory. Ebitdar is a variation of ebitda that excludes rent and. Each retail store will have its own set of key revenue and expense line items.

A 4 wall ebitda is just the ebitda for a retail store. They are going to fire all the existing corporate people so they dont care about their expense. The metric same store sales four wall contribution that wall street uses to measure retailers success and the expectations and shopping journey of today s digitally empowered shopper is not aligned with the reality of today s retail landscape. What is 4 wall ebitda.

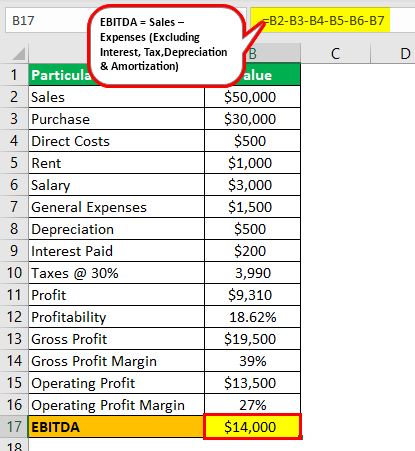

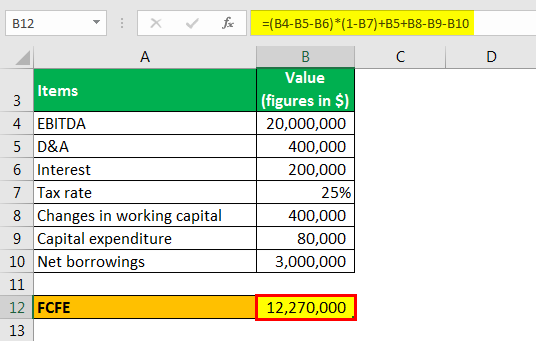

Ebitda is a way to measure profits without having to consider other factors such as. It includes cogs labor rent and other 4 wall expenses. How to calculate ebitda. These expenses that pertain only to the store are referred to as 4 wall expenses.

Managing to your store p l will create greater overall profits then simply reading the results at month end. Can ebitda multiple be negative.