City Of Virginia Beach Personal Property Tax Extension

The payment date of business tangible personal property tax is june 5.

City of virginia beach personal property tax extension. Wavy virginia beach has given residents more time to pay their personal property and real estate taxes. Hardship to apply for an extension on paying various taxes. Personal property tax bills are blue in color and are mailed at least 30 days prior to the due date. The city said in a news release tuesday payments which are.

Learn more about the meals tax. Virginia beach city has one of the highest median property taxes in the united states and is ranked 349th of the 3143 counties in order of median property taxes. Prorated supplemental bills. This bill will contain only the current year taxes due.

The personal property tax rate on cars is listed as 4 100. The city s financial adviser did discourage the city from eliminating the meals tax alice kelly the virginia beach finance director said earlier in the meeting. Motor vehicle personal property tax proration. A letter outlining the temporary ordinance related to meals tax was mailed to businesses having an associated city of virginia beach meals tax account.

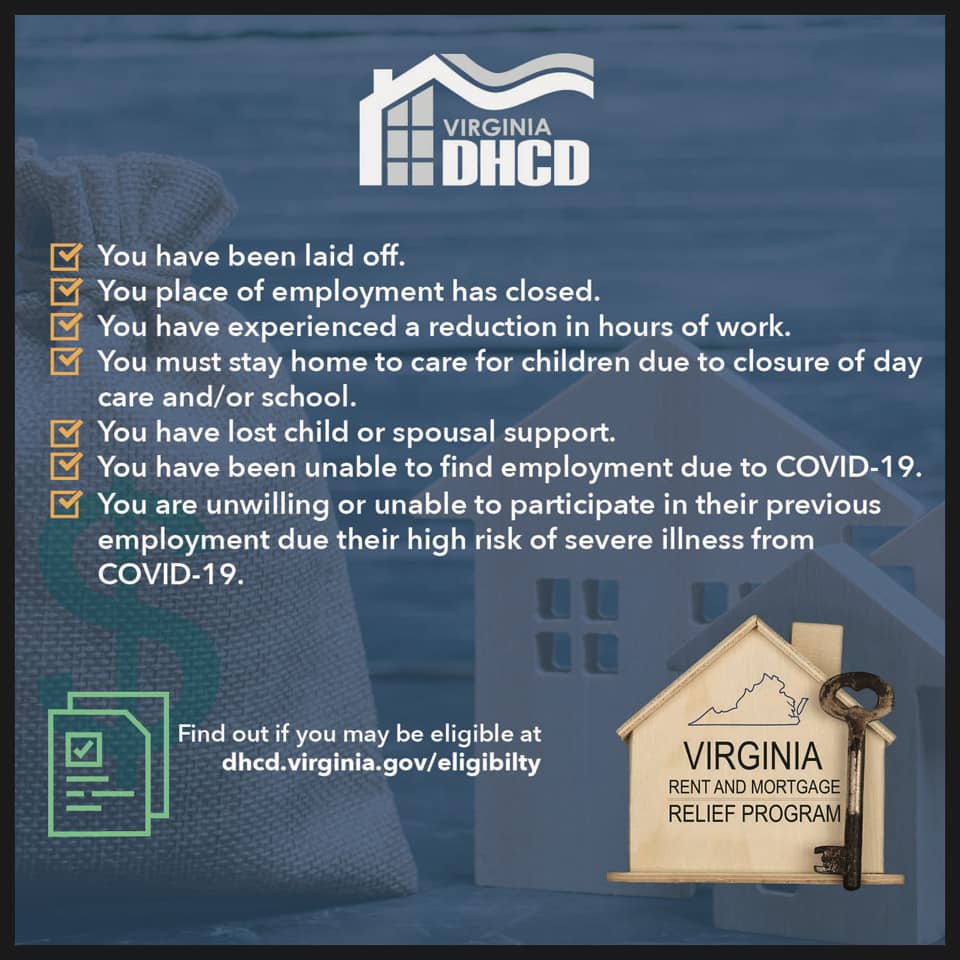

The city of virginia beach recognizes that small businesses are being impacted by the covid 19 pandemic. Personal property tax bills. If you have any delinquent taxes due on that account the message shown below will appear on your bill. The median property tax in virginia beach city virginia is 2 235 per year for a home worth the median value of 277 400.

Virginia beach lawyer accused of trying. Virginia beach city collects on average 0 81 of a property s assessed fair market value as property tax. Personal property taxes are due on june 5th annually. The treasurer is responsible for preparing mailing and collecting the taxes based on what the cor discovers to be unbilled tangible personal property.

This annual business personal property tax return must be filed with the commissioner of the revenue by march 1 unless an extension is requested in writing and granted. Personal property tax payments. In james city county personal property taxes are. Therefore we have real estate taxes on real estate and personal property taxes on taxable property other than real estate.

The city s treasurer has developed. At 9 00 am edt in response to president signing the program s extension legislation. Personal property taxes are assessed each year by the commissioner of revenue s cor office for all personal property garaged within the city of virginia beach.

/arc-anglerfish-arc2-prod-tronc.s3.amazonaws.com/public/SAEVDE63UFAC5FN3R6XND5J4YI.png)

.jpg)