Coffee County Property Tax Bill

Ad valorem means according to value.

Coffee county property tax bill. The millage rate is a determining factor in the calculation of taxes. We would like to show you a description here but the site won t allow us. Property tax information last updated. Coffee county tax commissioner coffee county georgia.

Learn how to pay ems ambulance bills. Coffee county al property makes every effort to produce and publish the most accurate information possible. This gives you the adjusted tax bill. 67 5 1601 is responsible for discovering listing and valuing each piece of property in coffee county.

September 3 2020 you may begin by choosing a search method below. However this material may be slightly dated which would have an impact on its accuracy. Pay taxes online disclaimer the coffee county revenue commissioner s office makes every effort to produce and publish the most accurate information possible. Nor is it a reason for penalty and interest charges to be waived if the tax bill becomes delinquent.

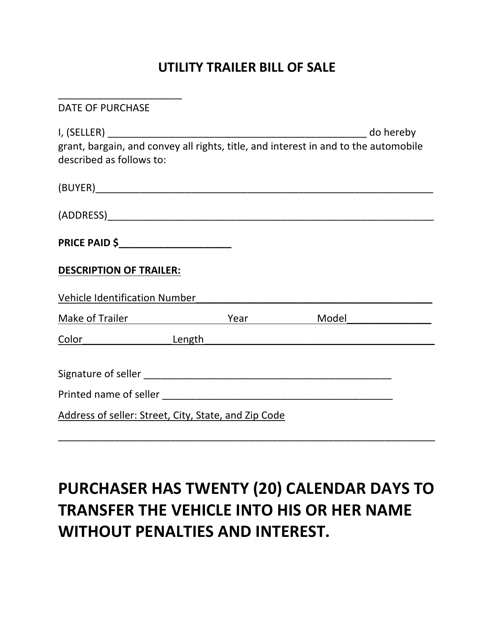

Coffee county taxes are for the calendar year of january 1 through december 31 of the same year. The property owner may be entitled to a homestead exemption if he or she owns a single family residence and occupied it as their primary residence on the first day of the tax year for which they are applying. Renewal of vehicle registration. This includes both real property and tangible personal property.

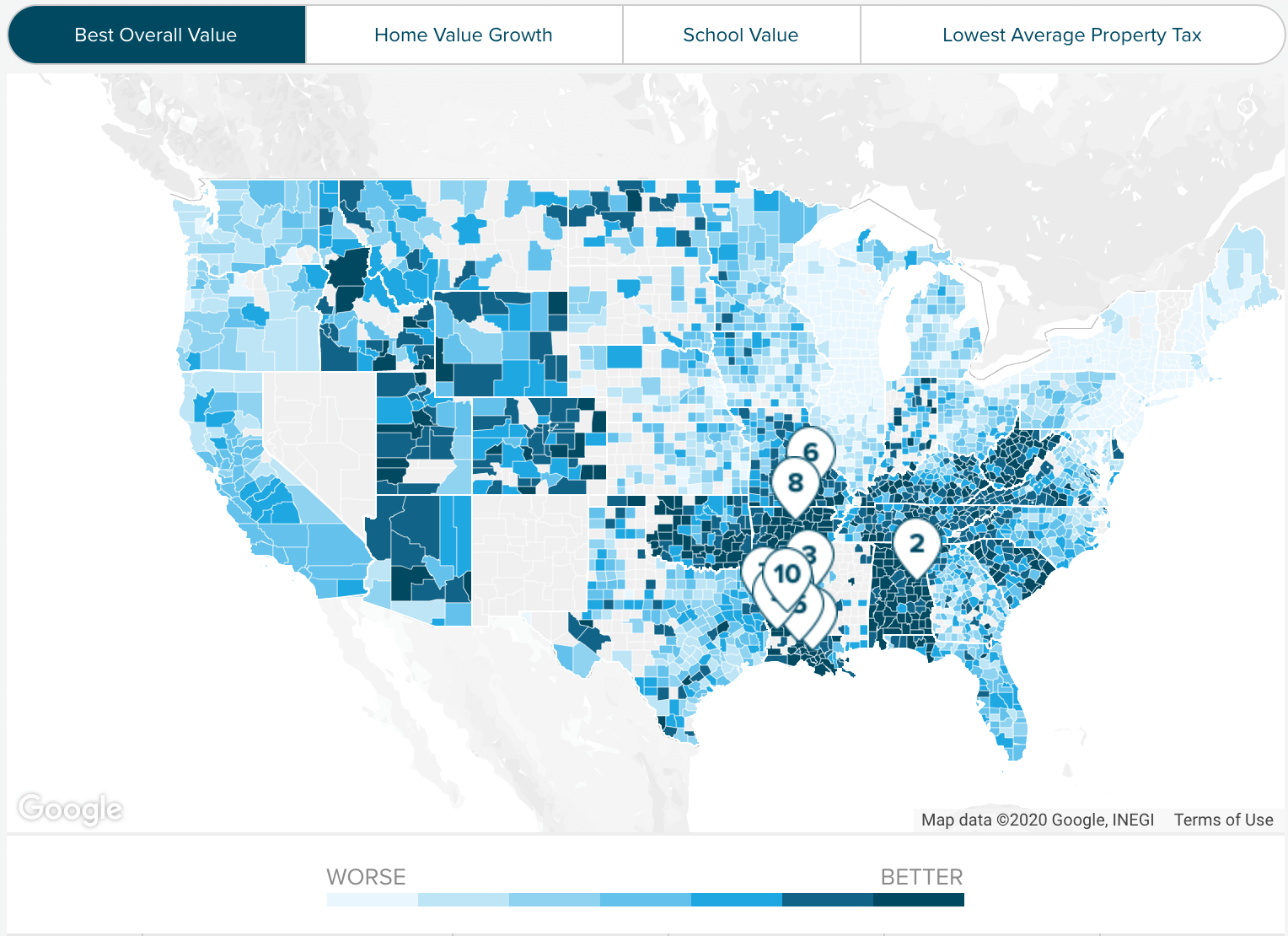

General tax information the ad valorem tax more commonly called property tax is the primary source of revenue for local governments in georgia. However this material may be slightly dated which would have an impact on its accuracy. A mill is 1 per 1000 of assessed. View an example taxcard.

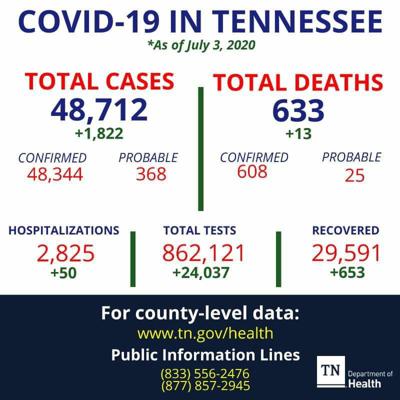

Any errors or omissions should be reported for investigation. The property assessor is responsible for appraising the property values on which taxes are assessed. The assessor of property according to tennessee state law t c a. Pay court costs fines and traffic tickets.

/cushions-on-sofa-at-home-against-wall-956468536-b1d4a42daa31480fa3f04ed7d4d94f4b.jpg)