Coffee County Property Tax Rate

67 5 1601 is responsible for discovering listing and valuing each piece of property in coffee county.

Coffee county property tax rate. Property owners are presumed to know that taxes are due without personal notification. Upon the filing of the lawsuits chancery court collects delinquent property taxes plus statutory interest and penalty court costs attorney fees and other costs associated with the collection of delinquent taxes for coffee county and the. Property tax information last updated. In coffee county suits filed by the county and by the cities of manchester and tullahoma to collect delinquent property taxes are filed in chancery court.

Tennessee law does not require the mailing of tax notices indicating the amount of taxes due. The median property tax in coffee county tennessee is 913 per year for a home worth the median value of 119 200. Coffee county al property makes every effort to produce and publish the most accurate information possible. Your alabama taxes are calculated using your property s assessed value.

Coffey county courthouse 110 s. The assessor of property according to tennessee state law t c a. How are reappraisal values established. 5 mills 0 005 district 1 schools county 12 mills 0 012 district 48 schools enterprise 11 mills 0 004 district e schools elba 11 mills 0 011.

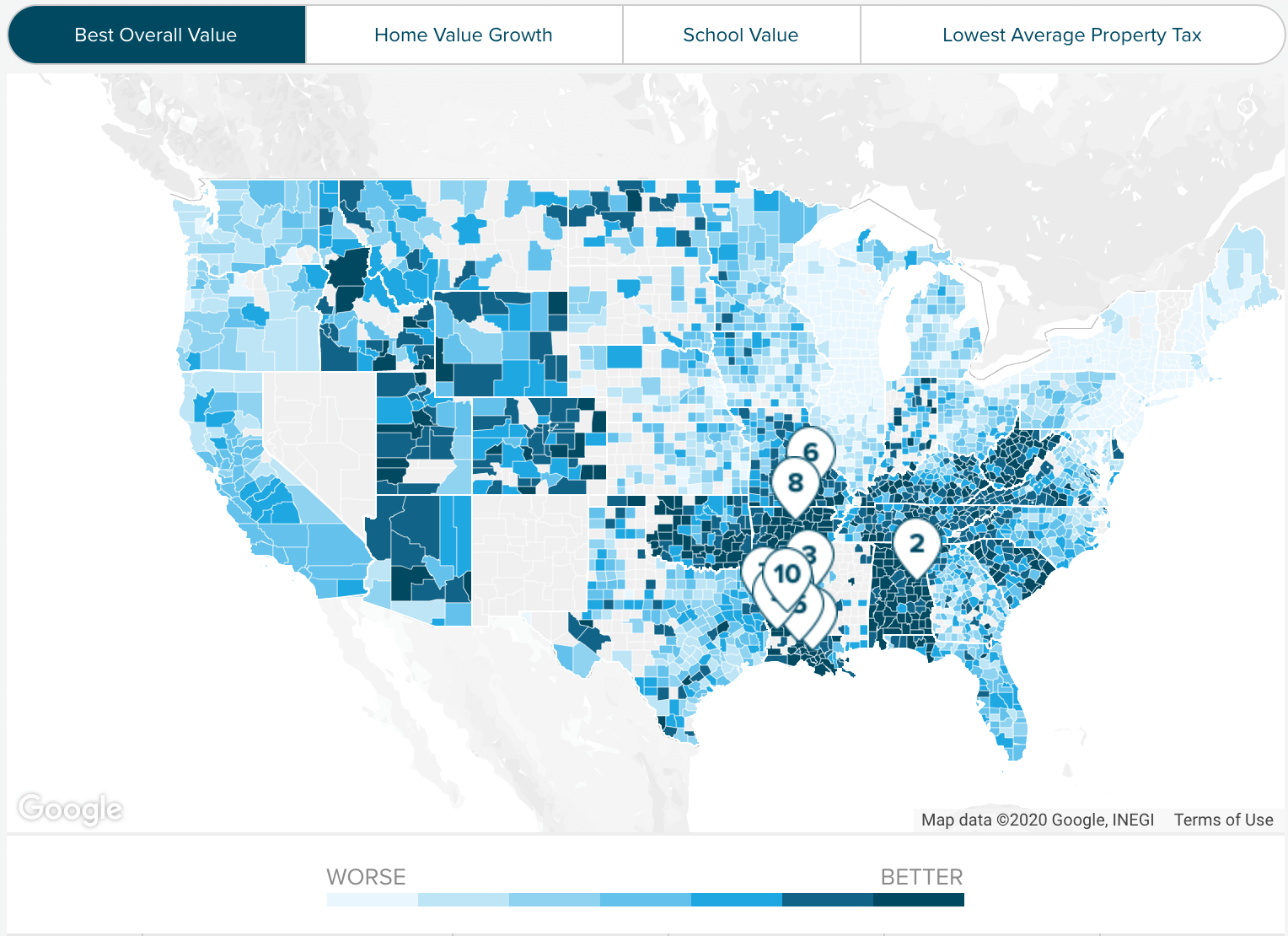

Coffee county collects on average 0 77 of a property s assessed fair market value as property tax. This is called the certified tax rate. Tennessee is ranked 1641st of the 3143 counties in the united states in order of the median amount of property taxes collected. 6th st room 203 burlington ks 66839.

View an example taxcard. The coffee county commission sets the annual tax rate. 10 5 mills 0 0105 county wide schools. This includes both real property and tangible personal property.

September 3 2020 you may begin by choosing a search method below. The 2018 reappraisal was based on coffee county property status as of january 1 2018. Any errors or omissions should be reported for investigation. Pay taxes online disclaimer the coffee county revenue commissioner s office makes every effort to produce and publish the most accurate information possible.

However this material may be slightly dated which would have an impact on its accuracy.