Coffee County Property Tax Records

The assessor of property according to tennessee state law t c a.

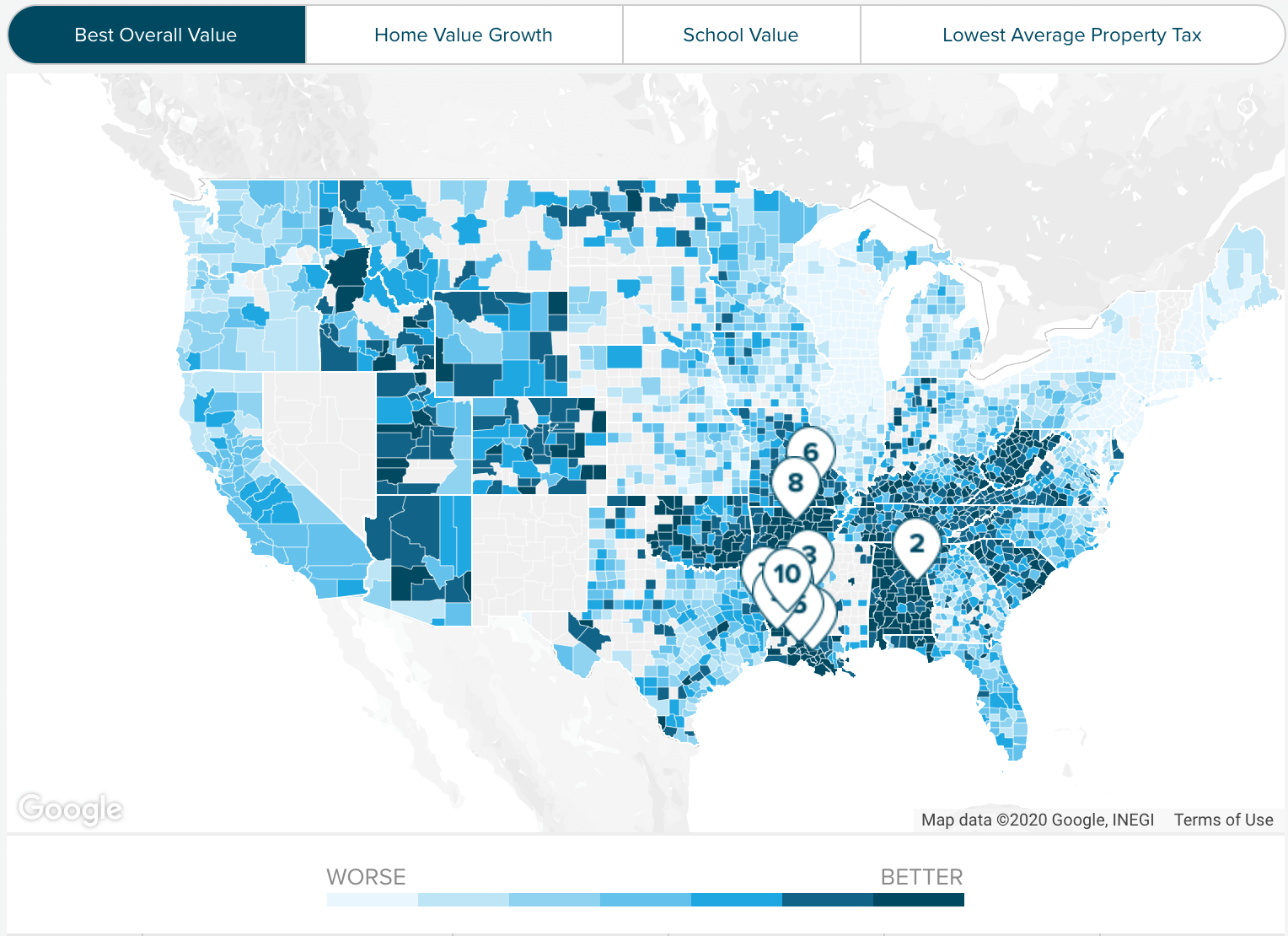

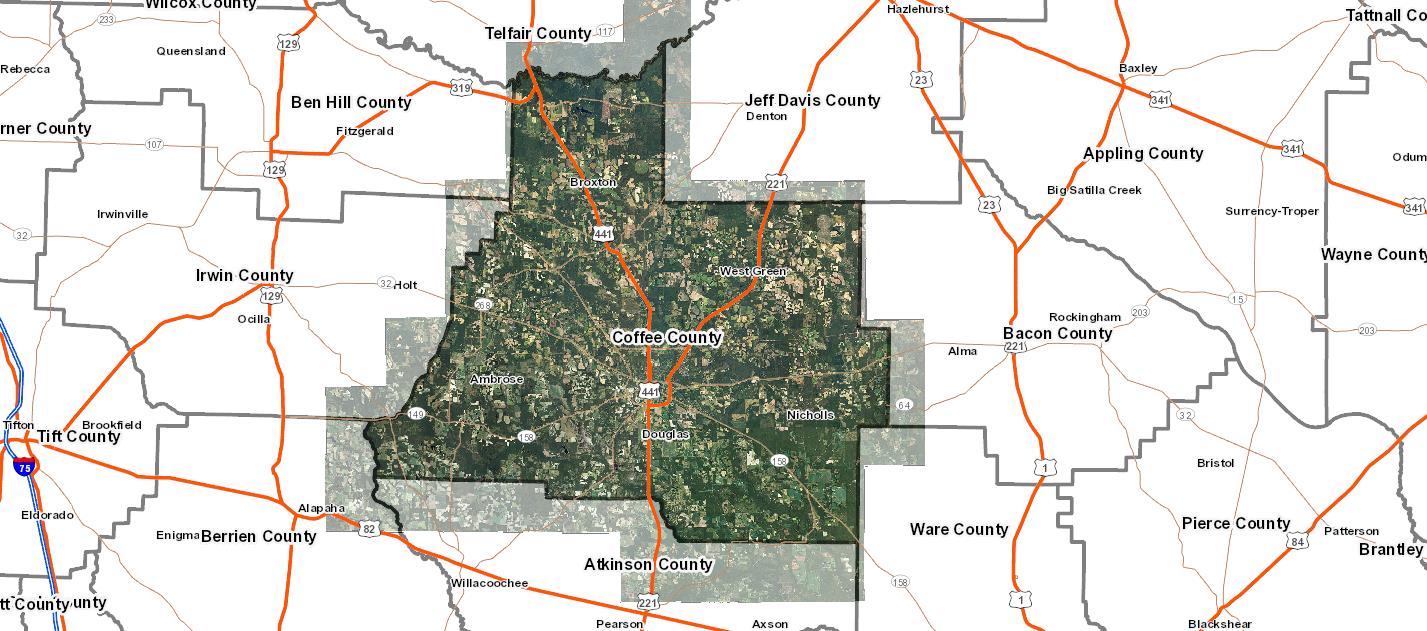

Coffee county property tax records. The millage rate is a determining factor in the calculation of taxes. Ronald burns revenue commissioner phone. Coffee county tax commissioner coffee county georgia. The assessor of property must keep current information of the ownership and characteristics of all property.

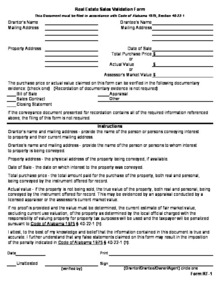

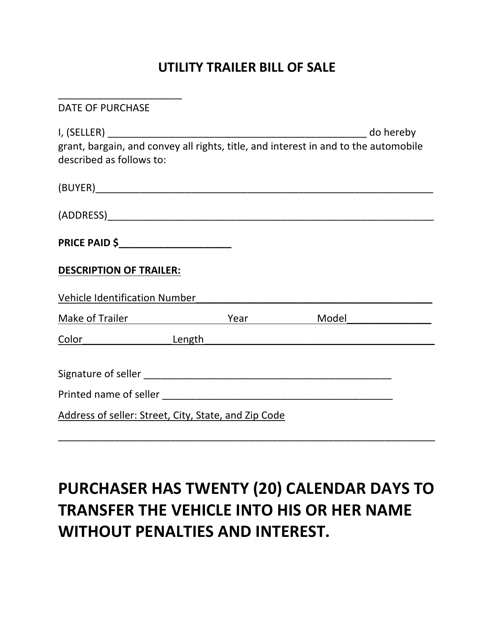

Public property records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Taxes coffee county al property makes every effort to produce and publish the most accurate information possible. Ad valorem means according to value. A mill is 1 per 1000 of assessed.

Coffee county property records are real estate documents that contain information related to real property in coffee county georgia. However this material may be slightly dated which would have an impact on its accuracy.