Coffee County Property Tax Sale

Thanks for your interest and we look forward to hearing from you next year.

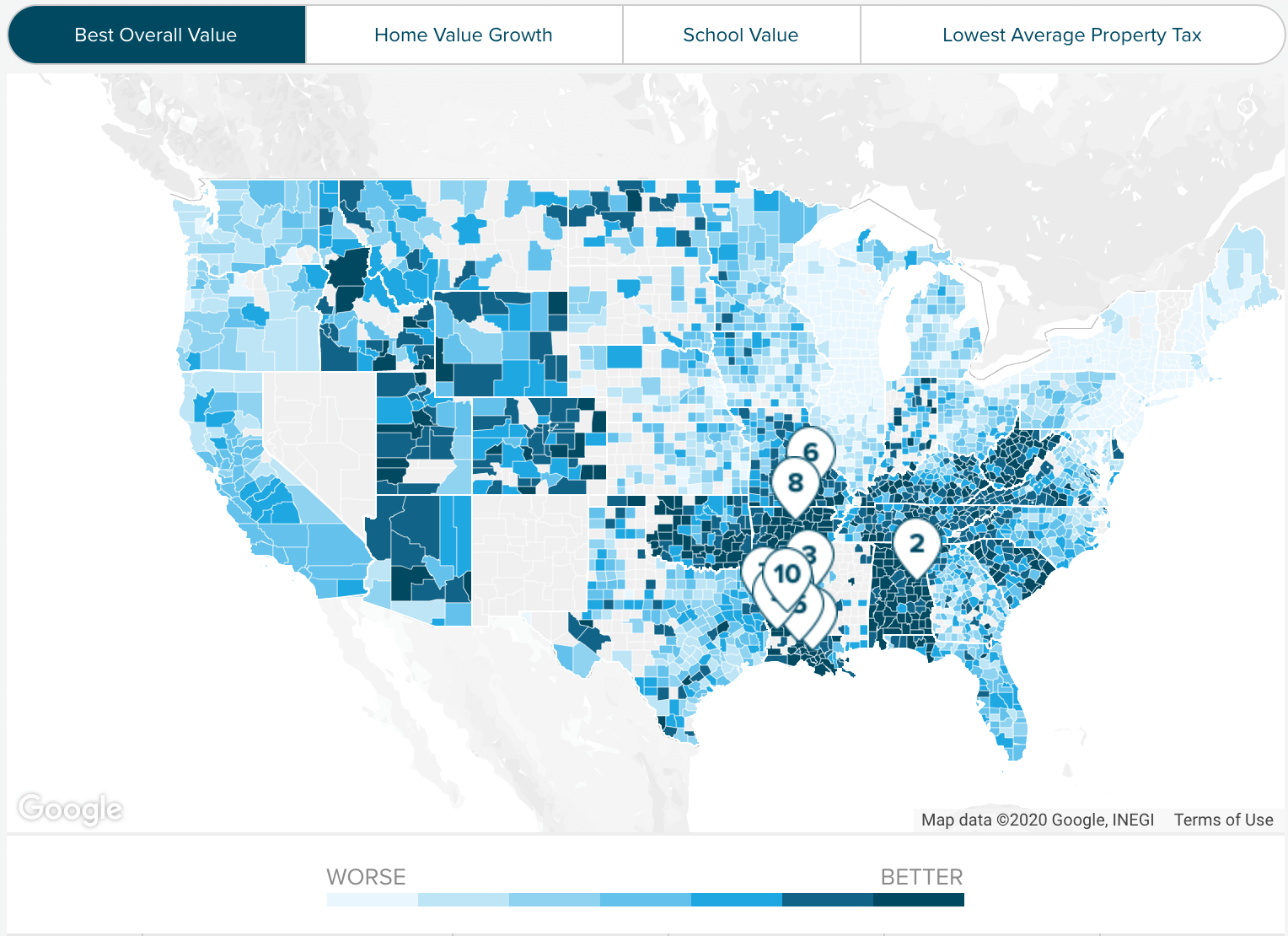

Coffee county property tax sale. 620 364 5532 or 800 824 4983. The only time postal cancellation is not honored is when delinquent taxes are turned over to chancery court on april 1st. On march 1st county taxes become delinquent and begin to accrue 1 1 2 penalty and interest on the first day of each month. The property is available for purchase from the state by making application.

The coffee county board of tax assessor s office should be contacted for more information on property values. Any errors or omissions should be reported for investigation. The coffee county revenue commissioner s office disclaims any responsibility or liability for any direct or indirect damages resulting from the use of this data. The phone number is 912 384 4895.

6th st room 203 burlington ks 66839. Because interest and penalties accrue each month and costs associated with the tax suit may be incurred from time to time please call 931 723 5132 for the current tax amount due for delinquent coffee county and city of manchester property taxes. Property tax information last updated. View an example taxcard.

The coffee county commission sets the annual tax rate. Coffee county al property makes every effort to produce and publish the most accurate information possible. 67 5 1601 is responsible for discovering listing and valuing each piece of property in coffee county. Final notice of sale.

This includes both real property and tangible personal property. However this material may be slightly dated which would have an impact on its accuracy. Property subject to delinquent tax sale on november 2 2019. Notice there will be no sale tomorrow.

Coffey county courthouse 110 s. Tax website if you accept the disclaimer view the revenue website. The assessor of property according to tennessee state law t c a. Call 931 455 2648 for the current amount due for delinquent city of tullahoma property.

The coffee county tax commissioner s office should be contacted for more information on inquiries about billing and collection of property taxes.